Important Mandatory Sage Intacct 1099 Functionality Changes

Mandatory changes affecting 1099-MISC Box 7 – Non-Employee Compensation.

The IRS has changed reporting requirements for Non-Employee Compensation. Previously, you reported on non-employee compensation using the 1099-MISC Form with Box 7. For the 2020 tax year, the IRS requires you to report this information on the 1099-NEC form with Box 1.

While you can still tag transactions to 1099-MISC Form Box 7, this option will not be available for transaction tracking after our 2020 R4 release on November 15, 2020. It is best to start updating 1099 default information for your vendors and migrating past transactions over to the 1099-NEC Form Box 1 now. Once it is released, you may receive an error when attempting to post a bill from certain vendors. To avoid this, Sage Intacct recommends that you update all Vendor records that have a configuration setting of Form 1099-MISC, box 7 by Friday, November 13, 2020.

Migrate 1099-MISC Box 7 values to the 1099-NEC form

There are different options to update this information for vendors and transactions. Select the option that best suits your needs from the list below.

Here are the steps you should take to update your vendor records.

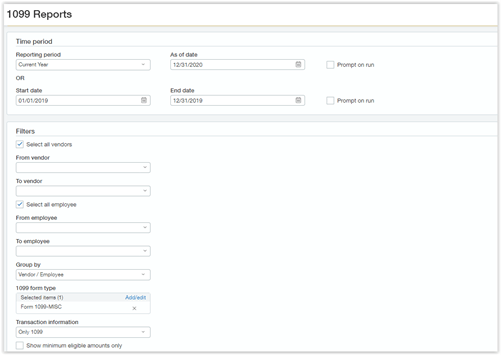

Step 1: Run the 1099 Report to show all current 1099 activity per vendor.

Step 2: Identify all 1099 Vendors that need to be edited in your system.

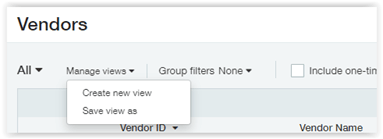

- Navigate to: Accounts Payable > All tab > Vendors.

- Click the Manage Views dropdown and click Create New View:

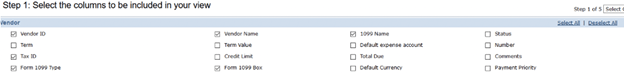

In the first step of the Wizard, select the fields as shown below:

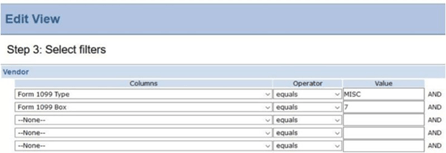

In the third step of the Wizard, create the filter shown below:

In the final step of the Wizard, give your view a descriptive name and click save. Then select the new view in the dropdown menu on the top left of the vendor list screen.

Step 3: For vendors posting to a single 1099 vendor type of 1099-MISC, box 7, update the records using one of these options:

Option 1: Manually update each Vendor record

- Click edit on each vendor record.

- Click on the Additional Information tab.

- Click on the blue Form 1099 link.

- Change the Form Name to Form 1099-NEC and change the Default 1099 Box to 1.

- Click Save to exit the 1099 Setup.

- Click Save to exit the Vendor Setup.

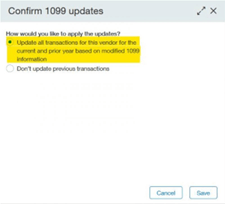

When you click Save, the following screen will appear. Select the option highlighted below, then click Save.

Option 2: Use the transaction update import template to edit the vendor record settings.

- Navigate to Company > Setup > Import Data.

- Click on the template link for Vendor 1099 Transaction Update to download the spreadsheet template.

- Complete the template for all vendors with a default 1099 setting of Form 1099-MISC, box 7. (Use the view created in Step 2 above to identify these vendors.)

- Recommended columns to include in the template are:

- VendorID

- Default 1099 Type

- Default 1099 box

- UpdateTrans

- FromDate

- ToDate

- Save the completed template in CSV format.

- Navigate to Company > Setup > Import Data.

- Click on the import link for Vendor 1099 Transaction Update to import the spreadsheet template.

Step 4: Update vendors posting to multiple 1099 vendor types.

In the rare situation where you have vendors that are posting to multiple 1099 vendor types (for example, 1099-MISC box 7 and 1099-MISC box 1), contact us for support at support@kerrconsulting.com.

Step 5: Reconcile balances.

Use the 1099 report from Step 1 to reconcile balances.