General Ledger

BUILT FOR MAXIMUM VISIBILITY, SCALABILITY AND FLEXIBILITY

Effortlessly support your company’s unbounded growth—from inception to the IPO and beyond— and gain deep, real-time visibility into every corner of your organization. The general ledger is the heart of your financial system, and we’ve designed ours with the most innovative and flexible architecture on the market today. Now you can easily handle your entire accounting and financial management process,

including automated revenue recognition, global consolidations, project accounting, and much more.

KEY BENEFITS

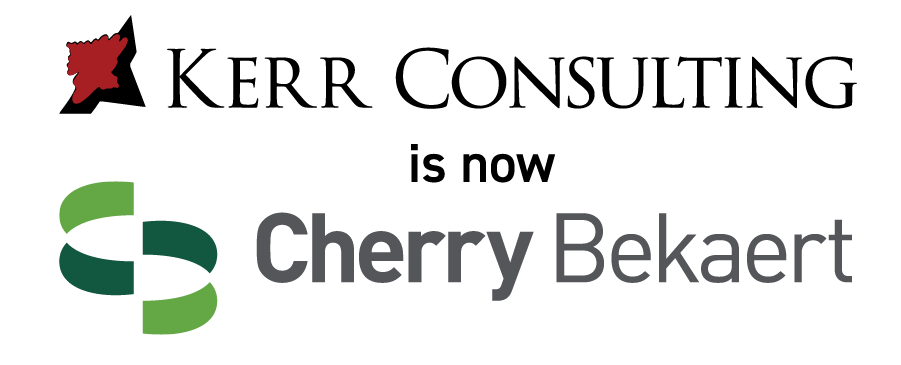

LEVERAGE UNIQUE MULTI-DIMENSIONAL VISIBILITY

The revolutionary Intacct general ledger design enables you to use dimension values—instead of old-fashioned account segments—to capture the business context of your transactions, operational measures, and budgets. It’s how you can easily track performance by customer, project, fund, or any other business driver, while simultaneously simplifying your chart of accounts.

SCALE EASILY WITH MULTI-ENTITY MANAGEMENT

Easily manage the financials for multiple entities across domestic and global locations. You can automate currency conversions, produce consolidated financials at the push of a button, and get consolidated reports without waiting for month-end.

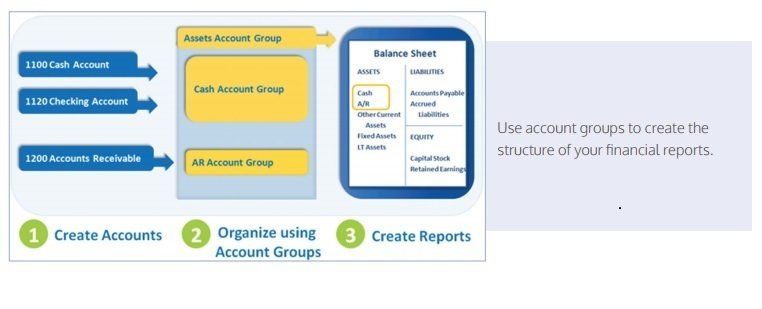

SEE IT ALL WITH MULTI-BOOK FUNCTIONALITY

Track your performance by multiple accounting standards all in a single system. You can view performance on U.S. GAAP, IFRS, and cash bases— side by side for better visibility—as well as easily report on tax, country, or industry-specific bases. Close efficiently with a multiledger architecture Close your sub-ledgers all at once or independently, in stages, for a more efficient period-end. You can continue to operate "business as usual" during the close period by closing one ledger while others are still processing transactions.

KEY FEATURES

MODERN ARCHITECTURE

Multi-ledger architecture: Manage the close process with sub-ledgers you can close independently.

Real-time posting:

Get up-to-date visibility with transactions that post in real-time to both the sub-ledgers and general ledger.

Streamlined Chart of Accounts:

Use general ledger dimensions to reduce the number of accounts you manage while retaining visibility as your business changes.

Multi-entity architecture:

Grow into any business structure with a general ledger that provides both visibility and flexibility for managing domestic and global entities.

Transaction definitions:

Visually configure businessprocess document workflows to control how transactions post to the accounts you specify.

MULTI-DIMENSIONAL GENERAL LEDGER

Pre-built dimensions:

Capture and store the business context for every transaction, budget, and measure in the general ledger with prebuilt dimensions for project, customer, location, department, vendor, item, employee, and class.

User-defined dimensions:

Capture and store additional business context for each transaction, budget, and measure with user-defined dimensions.

Required dimension values:

Ensure data quality by making dimension values mandatory for transactions that post to specified accounts.

Auto-populated dimension values: Simplify data entry and improve accuracy by autopopulating values for specified dimensions based on values of other dimensions.

MULTI-BOOK GENERAL LEDGER

Multiple pre-defined books:

Set up Intacct General Ledger as cash, accrual, or both; every transaction automatically posts to the correct book enabling, for instance, accrual-based firms to more clearly see the impact of cash transactions.

User-defined books:

Create additional books that support reporting by different standards—from IFRS and local GAAP to industry-specific ones.

Side-by-side multi-book reporting:

Create reports that span books to show comparative performance by different bases.

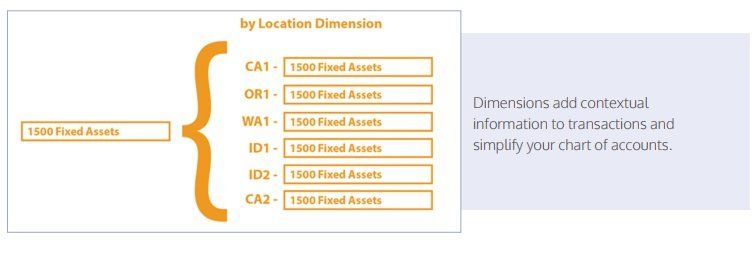

FLEXIBLE REPORTING

Account groups:

Combine accounts to define account groups that meet your specific reporting requirements. Budget accounts: Store budgets to enable granular budget vs. actual reporting. Statistical accounts: Store non-financial data to capture and report on operational metrics and ratios.

JOURNAL ENTRY MANAGEMENT

Flexible journal entry approvals:

Specify journals that require approvals in a specified sequence from named approvers, and keep approvals timely with automated email notification.

Journal entry import:

Quickly populate beginning account balances, journal entries, and budgets by importing data from spreadsheets and other applications.

Journal entry templates: Define templates enabling non-accounting users to enter general ledger transactions without having to deal with the intricacies of account numbers, departments, and locations.