Finance Leader Guide to Sales Tax 4 Actionable Steps

THE FINANCE LEADER’S GUIDE TO SALES TAX

4 actionable steps to operationalize your sales tax strategy

“A strategy, even a great one, doesn’t implement itself.”

This simple, yet spot-on quote from strategy execution authority Jeroen De Flander says it all. Even the most expertly crafted sales tax strategy won’t help you improve compliance unless you sync it with your day-to-day business operations.

Executed properly, a fully operationalized tax compliance strategy will allow you to:

- Address new or newly enforced tax compliance requirements

- Meet regulatory obligations efficiently and cost-effectively

- Mitigate risk related to sales and use tax

- Optimize investment in tax compliance technology and tools

Growth and sales tax: connecting the dots

In a series of Avalara-led surveys conducted by third parties, finance executives for retail, software, and manufacturing were asked to rank high-priority activities most relevant in driving business growth in the next 12 months. Their responses were markedly aligned, with only slight variances.

Across all industries, executives listed the following as key growth initiatives:

- Entering new markets or launching new products and services

- Adding staff or additional business locations

- Leveraging technology to get closer to the customer

Coincidentally, these are the very activities that can add risk and complexity to sales tax compliance. Furthermore, high-growth companies undergo these activities at a significantly higher frequency, driving the need for better accuracy and efficiency in tax management.

Why read this guide?

Operationalizing Your Sales Tax Strategy aims to help business leaders better understand the role tax compliance plays in growth and day-to-day operations and offers insights into how to put a routine, reliable process in place for managing sales and use tax that’s aligned with your business and growth goals

While sales tax doesn’t contribute to a company’s bottom line, how well you manage sales tax in relation to overall compliance and business planning can inform key decisions around financing, hiring practices, and company growth.

In addition to their growth strategies, finance executives also align on their biggest challenges related to managing sales and use tax and desire to make improvements in these five areas:

- Reduce the time, effort, costs and resources required to manage sales tax compliance

- Improve the accuracy of applying tax or exemptions to all transactions

- Grow the business without putting it at risk or missing out on revenue opportunities

- Create a better buying experience for customers 5. Minimize exposure from audits and reducing the likelihood of errors

- These issues should all be addressed by your operationalization plan and allow you to replace stopgap activities with a long-term strategy for managing sales compliance.

A four-step plan for successful strategy implementation

The business goals and objectives in your sales tax strategy will drive the blueprint for operationalizing it. While no two strategies or implementation plans will be the same, every operationalizing strategy should take the following criteria into consideration:

1. Identify areas of risk

HOW CONFIDENT ARE YOU THAT YOUR COMPANY IS MANAGING SALES AND USE TAX CORRECTLY?

Your first course of action is to scrutinize your tax management practices for any gaps or red flags that could result in noncompliance if left unchecked. Retail, ecommerce and fast-growing companies are routinely plagued by nexus and product taxability errors, which can lead to negative audit findings, penalties, and fees.

Manufacturers need to be highly cognizant of which items used in their business are fully exempt, partially exempt or taxable. It’s a complex process that can take its toll.

“We had to have someone dedicated almost full-time to watching the rules in each county, municipality, and state where we sell,” says Barb Mika, sales accounting supervisor for Oxbo International, a farming and food harvesting equipment manufacturer. “The error rate was very sizable. We had been audited quite a few times.”

95%

of financial professionals believe that sales and use tax compliance has become more difficult to manage in recent years

It’s easy to see why so many companies struggle with getting it right. In fact, according to a 2017 Wakefield Research study, the majority (95 percent) of financial professionals surveyed agreed that sales and use tax requirements have gotten increasingly more difficult to comprehend and comply with in recent years.

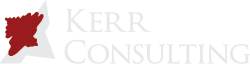

Nexus confusion is also common, according to Wakefield Research data, with 94 percent of companies unclear on exactly what determines a taxable connection to a state and requires collecting and remittance of sales tax. Figure 1 shows the percentage of financial professionals who were able to determine whether statements about sales tax nexus were true or false.

Given that many states differ in how they determine nexus, this isn’t surprising. Even fundamental business practices — remote workforce and contract employees, affiliate marketing, and internet sales — can create nexus, requiring you to register and collect sales tax in states where these activities are happening. Some states impose economic nexus, where the only requirement is revenue and/or volume of sales into a state.

Once you’ve identified the risks, the next step is to minimize or eliminate them. To get a better idea of where you might be falling short on compliance, start with a transactional tax risk assessment. If you’re still uncertain about your obligations, consider commissioning a nexus study or consulting with a sales tax specialist.

2. Optimize resource management

WHAT ACTIVITIES PREVIOUSLY CONDUCTED BY PEOPLE CAN BE DONE WITH TECHNOLOGY?

Growing companies, especially startups, need to be lean with funding and resources. Early stage companies tend to hire accountants or bookkeepers to manage tax compliance. Once a company has grown and matured, financial activities are brought in-house. Recent polls support this practice, with a little more than half of companies surveyed (56 percent) relying on staff or dedicated in-house CPAs to keep them compliant.

Once companies reach a certain growth threshold, managing sales tax without technology becomes costprohibitive. Wakefield Research found that, on average, companies employ six finance professionals who spend nearly 25 percent of their time on sales and use tax compliance related tasks. That’s significant spend for a non-core business activity. Most CFOs (7 in 10) say reducing resource costs on tax-related activities is a top priority in meeting their companies’ efficiency goals. Automating routine activities, like tax compliance, in the cloud or in your ERP is one way to achieve these efficiency goals — and should factor into your tax strategy and operations plan.

7 IN 10CFOS SAY REDUCING RESOURCE COSTS ON TAX-RELATED ACTIVITIES IS A TOP PRIORITY

“We were doing more business in different states, it was getting more complex, and taking more time from the team”

— Ray Duong, Finance Analyst, Argus Software

Once Argus moved to sales tax automation, compliance was much easier, admits Duong. “It was simple to set up, use, and maintain. You get a full listing of states and provinces, a summary of how much you sold, how much is taxable, and what you owe. At close, you go in and approve it.”

Tax automation frees up IT’s time as well. You want your IT resources focused on priority tasks, not burdened with uploading tax tables and adjusting tax data every time a rate or rule changes that impacts how you tax your goods and services. An expert IT team is knowledgeable about technology platforms and third-party software. Use them strategically to help you evaluate options and onboard a solution that will meet your long-term needs.

3. Do it right the first time — and every time

HAVE YOU BUILT RELIABILITY AND SCALE INTO YOUR COMPLIANCE PROCESS?

Systemic operations can be a struggle for many companies because they grow and change so quickly. Any new processes you put in place need to serve your business now and in the future. The ability to scale your tax solution with your business growth is critical.

Inevitably, relying on people — internal or outsourced — to manage tax compliance will become too risky or too costly. And tax management solutions that require tax table uploads or manual updates aren’t agile enough for fast-growing companies. SaaS solutions do the job better. In fact, having a reliable tax solution in place that instantly applies the right sales tax rates and rules was ranked as “very important” by financial decision makers in recent polls.

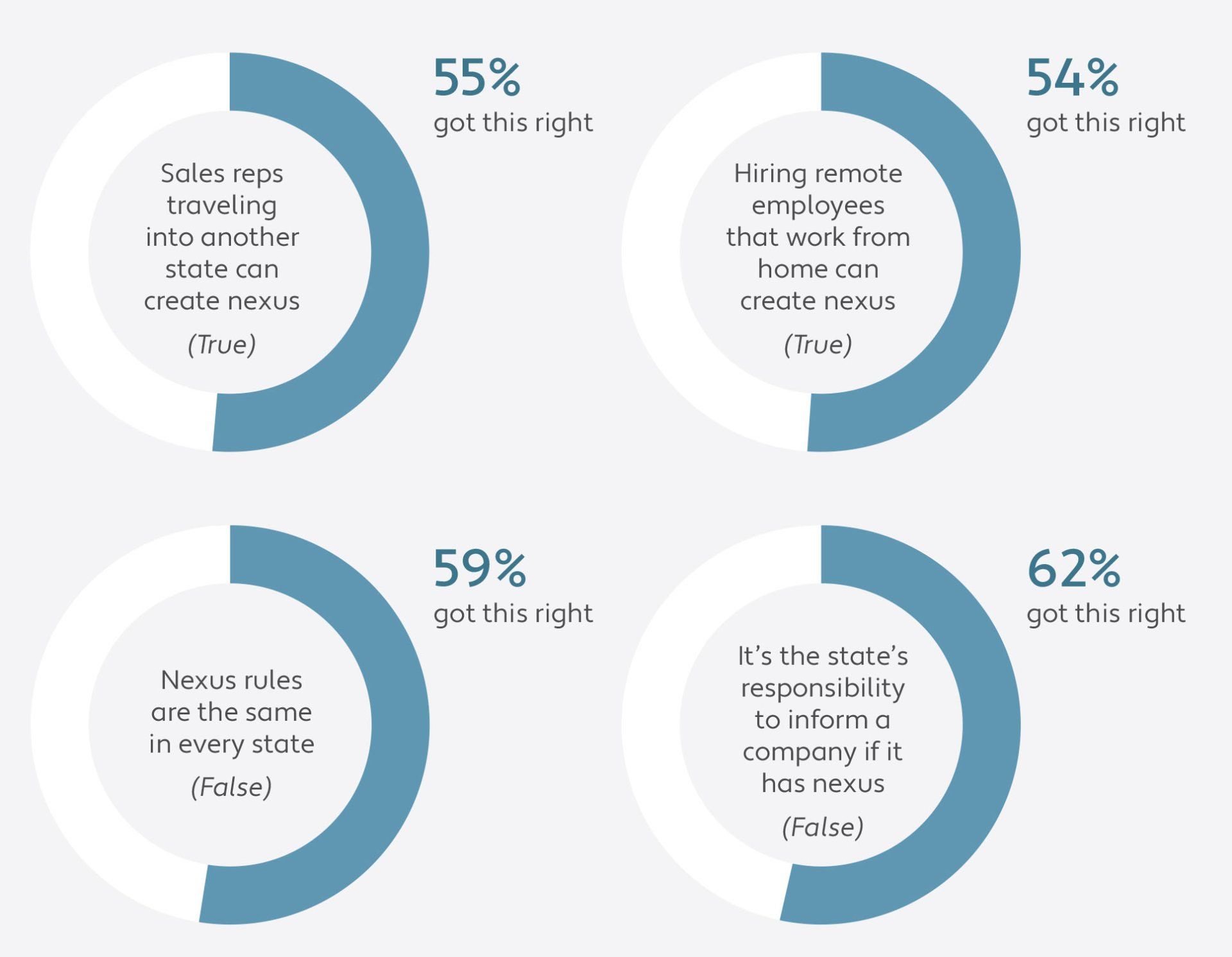

A 2016 Aberdeen Group survey revealed similar aspirations. Company executives shared that their main motives for onboarding tax automation are to improve tax data and tax calculation accuracy, drive better efficiency across the entire compliance workflow, and reduce the burden of sales tax audits

For growth-driven companies, sales tax complexity can be a challenge right out of the gate. Therefore, the sense of urgency for these companies to ready the business for change is there from the get-go as is the need to mitigate any risks that could impede growth.

“We were monitoring our exposure and potential risk, but in terms of actual reporting, we were literally doing it by hand. It was extremely manual,” says Jason Heckel, senior tax director for Zillow, a technology leader in the web and mobile real estate marketplace.

“I decided early on that the best solution would likely be to automate the true sales tax compliance side of it,” says Heckel. “I knew we needed a software solution that was easy to use, easy to plug in, and had the backend side of tax compliance Zillow needed. [From there] It was easy to determine which vendor to go with.”

Look for best-in-class solutions to maintain tax compliance and optimize productivity. SaaS solutions specific to tax management, integrated into your existing ERP or ecommerce systems, make it easy to instantly account for any changes in your tax obligations as you grow.

4. Plan for your future

WHERE WILL THE BUSINESS BE IN FIVE YEARS, HOW WILL THIS IMPACT TAX COMPLIANCE, AND HOW HAVE YOU ACCOMMODATED FOR THOSE CHANGES?

For most businesses, growth plans center around adding customers, entering new markets, hiring top talent, and launching new products. It’s on these “inflection points” where CFOs need to focus their attention, advises tax expert Malcolm Ellerbe, addressing blockers to a company’s ability to expand, get funding, or acquire another company, thereby creating a clear (and auditable) path for future growth.

The harsh reality is that sales tax isn’t going to get easier anytime soon. States are still playing catch-up with taxation of digital goods and services and ecommerce sales. Until a more ubiquitous process exists, the more you can predict and plan for these changes in your business, the better off you’ll be.

Think about your five-year plan. Will your tax compliance solution see you through major changes without disruptions to the business? Is it positioning you to grow without slowing you down?

THE HARSH REALITY IS THAT SALES TAX ISN’T GOING TO GET EASIER ANYTIME SOON

Think about your fiveyear plan. Will your tax compliance solution see you through major changes without disruptions to the business? Is it positioning you to grow without slowing you down?

These are important questions to keep in mind. You most likely chose your ERP or ecommerce system based on how well it would fit your business needs and its ability to adapt and grow with you as your needs change. Your tax solution should be held to the same standards and check all your boxes for reliability, scale, ease of use, and affordability.

“We upgraded our ecommerce system in 2017, and sales doubled in the first month,” says Jean Treimanis, chief financial officer for JL Marine, a Florida-based maker of shallow water boat anchors.

Dealers started using the company’s ecommerce system to place their orders, creating click-through nexus obligations in states beyond the direct sales team’s coverage area. Treimanis says she realized that staying in compliance as they added states was going to require a better solution, but “changing ERP systems is a massive, painful project, and we wanted to avoid that if we could.”

Having tax automation software integrated into your existing ERP and ecommerce system also allows for more centralized, real-time reporting and data management, making it easier to prove compliance and plan for growth. Switching on tax automation should be simple and not require any changes to your platform on the back end. For best results, opt for a SaaS solution with a pre-built connector to make the process as seamless as possible.

Expected returns on your sales tax strategy

Your sales tax strategy is set. Operationalization plans are underway. What’s next? Evaluation: Did you achieve what you set out to do and what benefits have you realized as a result of your efforts? While success looks different for everyone, it can help to see how other companies fared.

Surveys by TechValidate and Wakefield Research found that, on average, companies that use Avalara’s tax compliance software solutions:

- Cut the time spent managing sales tax by more than half

- Are 90% less likely to overcharge customers sales tax

- Reduce audit prep and compliance time from 37 days to 8 days

- Pass audits without penalty twice as often as other companies

Circling back to those five, finance leader identified tax compliance problem areas, these results are justification that a well-planned, well-executed sales tax strategy can solve for these, enabling you to achieve more efficiency in your business and realize revenue and growth goals more quickly.

Would You Like to Learn More?Call Us

800-352-4032